The project, led by Professor Isha Kimpel of the group, is in collaboration with numerous retail investors to form a market-driven force. As more investors join and replicate the trading strategy, the buying/selling power in the market gradually strengthens, creating a strong upward/downward trend in the short term, thereby influencing market prices to a certain extent.

Core of the project

In the current project, Professor Kimpel proposed the market linkage theory of "Hand in hand with investors, leading the market." By gathering the scattered capital of individual investors and building a consensus foundation, a powerful financial chain is established. When this massive financial chain concentrates its purchases on a specific cryptocurrency within a short period, it effectively drives market trends. This process, known professionally as "main capital layout," demonstrates the efficient aggregation and precise leverage effect of market funds through the combined strength of numerous investors.

- Convergence of consciousness: GS Group is essentially aggregating the consensus of all retail investors, collectively using their funds to drive the short-term fluctuations of a cryptocurrency, aligning with and driving market trends. Through the collaborative theory of "hand in hand with investors, leading the market," not only can individual user returns be secured, but investors at different levels within GS Group will also receive varying commission benefits.

- Main capital: The fluctuation of currency prices is essentially driven by the buying and selling behavior of funds, presenting a dynamic balance. When individual investors can form an effective alliance, their collective strength is sufficient to influence the direction of capital flow, thereby guiding the trend of price changes. Therefore, in Professor Isha Kimpel's logic, the strategy of "hand in hand with investors to lead the market" is an efficient investment philosophy. It emphasizes integrating individual resources to form a combined force similar to main capital, thereby maximizing investment returns. Ultimately, behind the fluctuations in the prices of currencies and the crypto market, it is all about the game and balance between capital flows and capital forces.

GS Group, as a core practitioner of the "Hand in Hand with Investors, Leading the Market" strategy, implements two precise operations to drive currency value every day. It is worth noting that the currency selected by the daily options contract plan is not the group manipulating the overall market trend. Rather, by flexibly utilizing its strong financial strength, it efficiently implements a quick-in and quick-out trading strategy in a short period of time to achieve rapid capital appreciation and target returns.

Summary: Professor Isha Kimpel of the Group achieves stable returns by integrating GS Group investors and collaborating with other institutions/main forces behind GS Group to influence market data. To ensure accurate predictions for profitable outcomes for all, it is not only dependent on Professor Isha Kimpel's professional analytical skills but, more importantly, on uniting the power of all retail investors to form an invisible main force, thereby exerting effective market influence. Relying solely on Professor Isha Kimpel's expertise, without the continuously expanding team strength of retail investors and a robust copy trading platform, it would be impossible to effectively drive market prices. However, not every investor can collaborate with GS Group. Team development is not merely about gathering people but requires continuous screening to retain seasoned investors who unconditionally trust the Group and can sustainably develop the team to create stable returns.

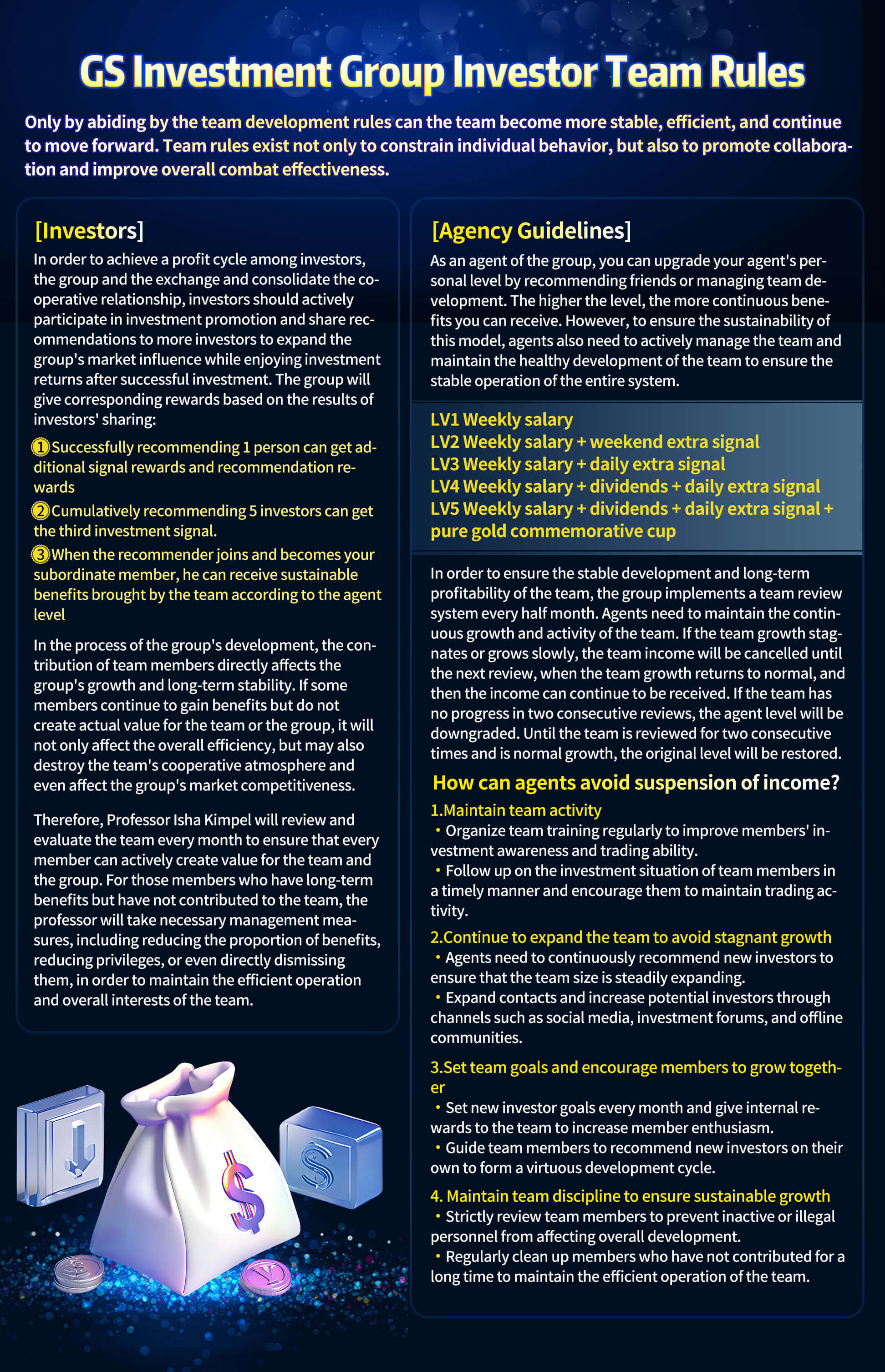

Therefore, the stability and success of returns fundamentally depend on the stability and development of the team. When the team is well-developed, not only will individual levels be improved and yields be higher, but also rewards and team commissions will be received while inviting each member.

Therefore, strengthening team building is not only the key to improving project operational efficiency and success probability but also an important safeguard for achieving a win-win situation between personal and group interests. By continuously optimizing the team structure and enhancing team cohesion and execution, we can ensure the efficient operation and sustained profitability of the market linkage theory 'Hand in Hand with Investors, Leading the Market.'

We consistently uphold the cooperative concept of 'co-creating, co-bearing, and co-enjoying,' emphasizing trust as the foundation, collaboration as the essence, and mutual benefit as the outcome. Every partner is our most important strength, achieving together and empowering each other are the core values of our long-term cooperation.

Under the guidance of this philosophy, the team's development also has clear welfare systems and rules to motivate the team's development.

The core of the team system lies in gathering the power of individual investors to collectively defend against market risks. Through unity and cooperation, individual investors can come together to form a powerful force of capital. This force not only effectively avoids risks in the investment field but also prevents being eroded, and is expected to achieve long-term stable profits.

VRECV Exchange is committed to enhancing its international reputation and traffic to become a world-class exchange, facilitating cooperation with more investment groups. Meanwhile, GS Group aims to lead investors in participating in options trading to achieve commission income and profit sharing, while relying on the platform mechanism to promote shared interests. In this process, individual investors' profits come from replicating the investment direction and portfolio taught by the group to obtain profits.

However, investors have also become a key driving force in promoting the development of the VRECV exchange and the GS Group. Investors, through successful accounts, actively participate in sharing and promoting, thereby further expanding the group's influence. This cooperative model not only promotes the steady growth of trading volume but also forms a sustainable, recyclable, and stable business ecosystem.